Four ways you can make IR35 work for you.

IR35 is coming to your sector in April of this year. Essentially it means that if you use contingent workers engaged through their limited company, and they’re subject to your supervision, direction or control (or the provision thereof), you’re going to have to change how you engage them. HMRC will consider these workers as employees. And believes a significant amount will be affected by the introduction of IR35. For large employers of contingent workers, this will present big challenges. But at People Group Services we believe there are also opportunities. Here are four.

1) Protect your business now and in the future

The Problem

IR35 will leave a lot of contingent workers on the wrong side of the law. Also, as HMRC rules change annually, many payroll solutions also find themselves in this position. Senior Management often don’t have complete visibility and problems are picked up when it’s too late.

The Solution

Right now you have very little visibility on your contingent workers’ limited companies and how they’re run. This potentially exposes your business to bad practice if your contingent workers transfer to more aggressive, unethical Umbrella options to avoid the reduction in their net pay. Vetting your contractors to ensure best practice could be an admin nightmare for your business. IR35 is an opportunity to take control. People Pay products set the standard when it comes to compliance. Our PEO product has actually been reviewed and recognised by HMRC. This gives you complete reassurance and security. By opting for a future-proofed solution, you remove the risk and secure your business from reputational damage.

Key Benefit: Your business is in complete control of its payroll solution and is protected as a result

2) Realise overhead and cashflow benefits

The Problem

Cashflow limitations and high overheads are common when it comes to payroll models.

The Solution

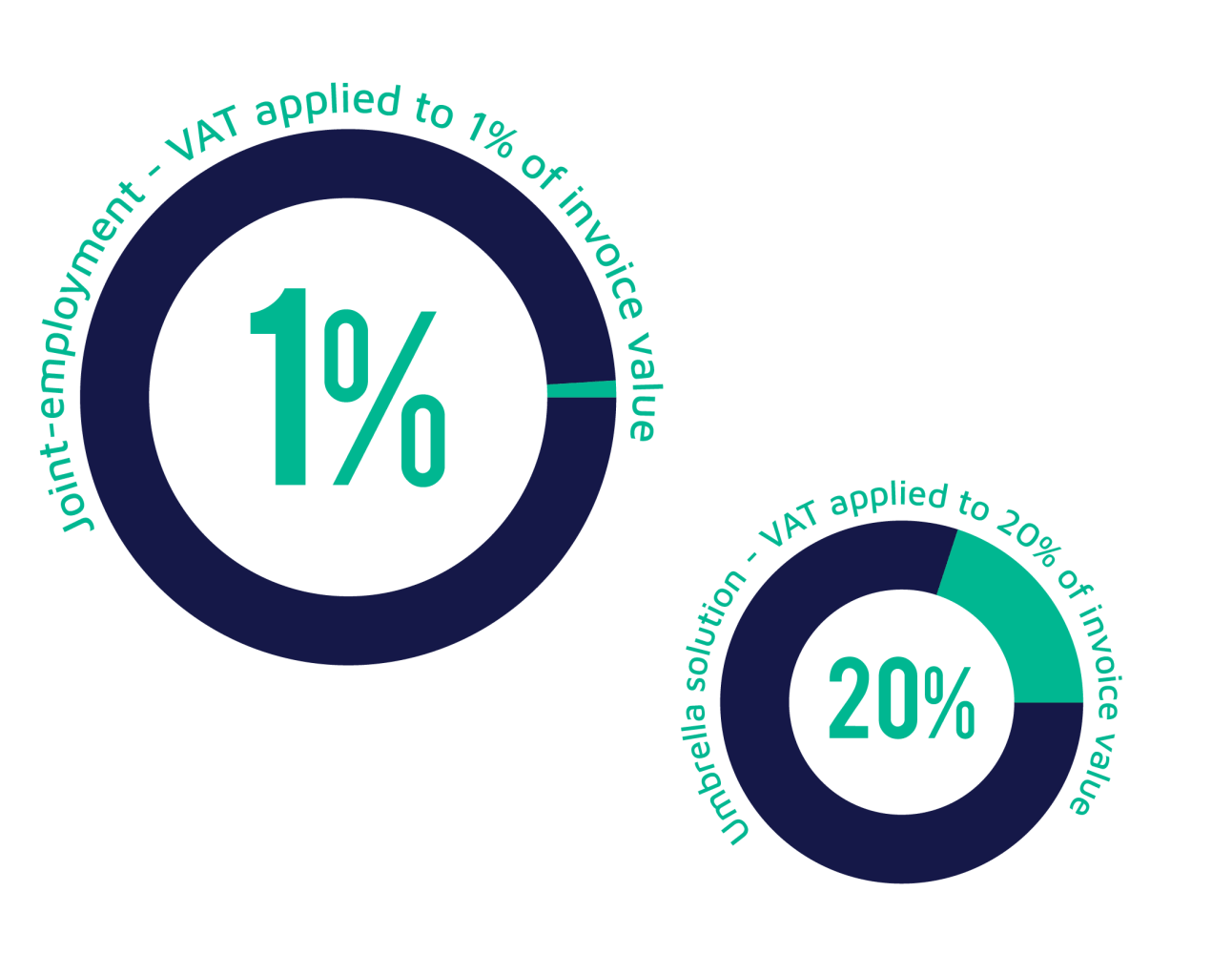

With People Pay’s unique HMRC recognised and reviewed Joint Employment Model, only 1% of the invoice attracts VAT. Compared to 20% with an Umbrella Solution. Banks will realise a cashflow improvement and an 19% reduction in the cost of payrolling contingent workers. This gives you the breathing space to save money or pass that saving on to your contingent workers with a higher gross daily rate, reducing the impact of IR35. When it comes to overheads, People Pay takes care of all of the admin around pay, which means your workforce can be optimised to focus on your core activity.

Key Benefit: Your business is commercially optimised post-IR35

3) Increase efficiency

The Problem

IR35 is going to bring upheaval to your business regardless of which route you choose. But the fact is that some routes are more expensive, risky and time consuming than others.

The Solution

You could take all your contractors on to your internal payroll, but this could significantly push your admin costs and headcount up. You could look at Umbrella pay options, and we offer this, but the payslips are complex and the deductions confusing for contractors who aren’t used to this method. In the recruitment agency world, some staff spend up to four hours a week purely dealing with Umbrella pay queries.. Our PEO option isn’t an Umbrella company or a tax product. It’s simply PAYE. Contingent Workers can easily see how much they’re getting paid with minimal deductions and clear payslips. This eliminates queries. It has no impact on your internal admin, leaving your people free to focus on the business.

Key benefit: Minimise the distraction and time drain of IR35

4) Increased contractor loyalty and attraction

The Problem

IR35 is going to hit contractors hard. Most of them will see a cut in income when they are put on payroll and their employers won’t match their previous rates. This will be unsettling. When IR35 was introduced in the public sector, contingent workers moved and there was a lot of disruption.

The Solution

While there will be a financial impact on contingent workers, you can mitigate it if you choose a best in class payroll solution. Our research shows that contingent workers value transparency and ease when it comes to pay. 84% would prefer a clear fee-free option with 64% stating that it would influence their choice of agency. That’s why we developed People Pay’s PEO (Professional Employment Organisation Model) solution. It offers the best candidate experience. We don’t do complicated deductions or tax products that sail close to the wind. Just clear and simple pay with an exceptional rewards programme. How contingent workers assess their next contract will fundamentally change and you could get ahead of this.

Key benefit: Becoming an employer of choice for contingent workers